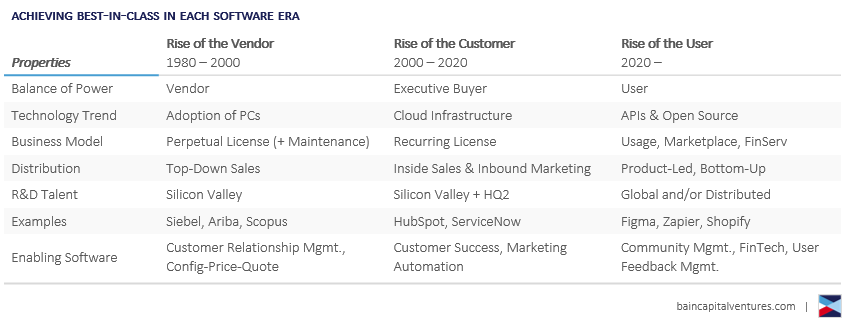

Bain Capital Ventures has a great analysis around the “next 20 years” of software.

While the last two cycles of software focused on the “economic buyer”: the CIO, CRO, CMO, or CFO, who was the ultimate check-signer and decision-maker, the focus on any software startup in 2020 begins with users, who are gaining more power to purchase and use their own choice of technology. Consumer demand to use iPhones at work, for example, was an early flash-point that ended up loosening IT’s hold on bringing technology to work. This empowerment was also initially prominent with developers choosing open source projects and dev tools, but has increasingly spread to other teams as diverse as design, marketing, and even manufacturing operations.

Ajay Agarwal and Kevin Zhang

The move from the “executive buyer” to the “user” is an important one and one that Rownd fully recognizes. The Rownd Data Platform gives developers tools to empower users and give them control over their data. Our focus is on the END USER experience and enabling developers to add data privacy in minutes.

Additionally, our pricing model seems to be right as well:

The next wave of software monetization goes beyond typical “per-seat” licensing, to other forms of revenue which are tied to usage, scale, and consumption, and include non-software sources like payments and data. For example, BCV portfolio company Attentive Mobile provides consumer-facing businesses with SMS marketing. Rather than charging on the number of marketers using the software, the company primarily monetizes on a fee that scales with message volume. As marketers see results with their campaigns, they send more messages — this alignment of value has powered Attentive’s unprecedented growth…. Companies that thereby figure out how to closely align their revenue with customer value can grow more naturally with the account, producing unprecedented net revenue retention (customer expansion) numbers with minimal sales effort or upselling. Great examples of this are payments revenues (Shopify), implementation services revenue (Guidewire), or a network-based marketplace take-rate (Coupa).